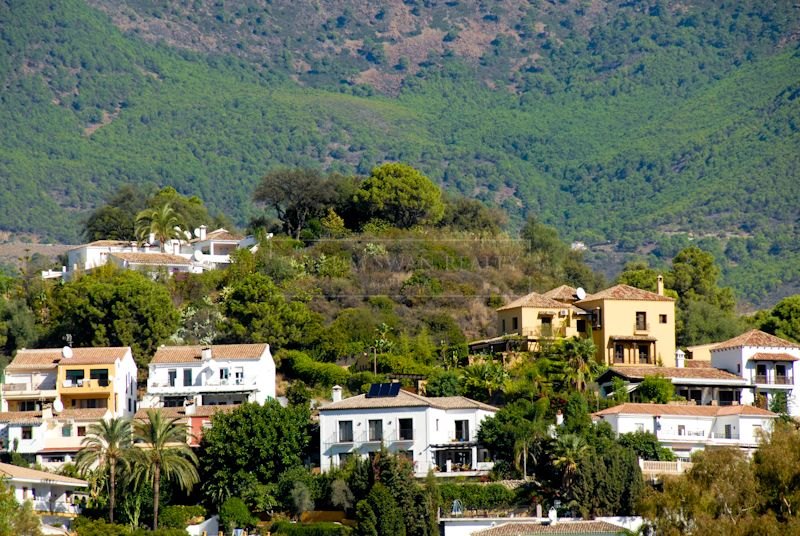

Marbella Property Market Developments

Louise Swan,

December 2015

|

Local News and Information

The media, when talking about the Marbella real estate industry, naturally likes to focus either on boom-time growth or recession-deep bust, but now that we’ve left both behind many haven’t caught up with the latest realities affecting this rather unique property market on the southern tip of Europe.

Firstly, when hearing or reading about the Spanish property market you should always differentiate between the domestic primary housing market and the secondary housing market – which in itself is divided between the general coastal areas and luxury parts such as Marbella. Why? Because they are essentially different markets that respond to different factors and are therefore not always in synch. The primary market relates to first residence homes for people across the villages, towns and cities of Spain, and as such responds primarily to the national economy. It saw a bottoming out of demand and prices last year, and is expected to begin the gradual process of recovery in 2015.

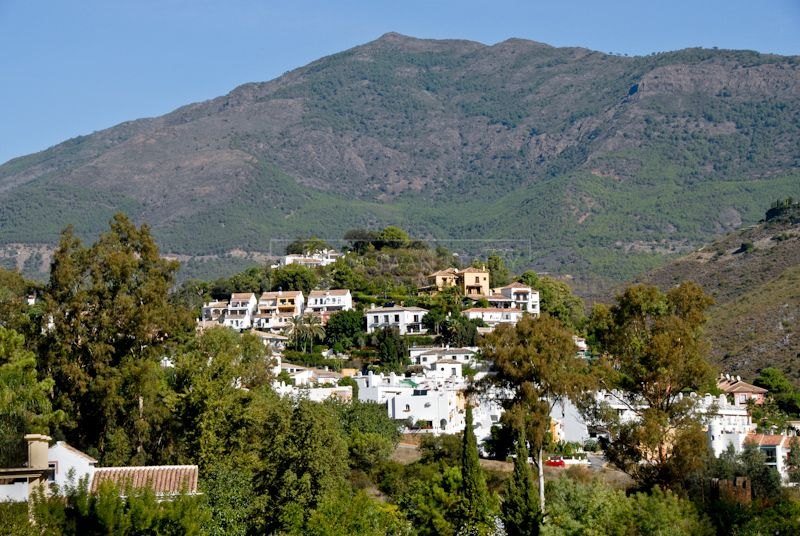

The secondary housing market, meanwhile, deals primarily with the holiday homes and relocation residences of mostly expat homeowners in areas such as the Costa del Sol, Costa de la Luz, Balearic and Canary Islands, Costa Blanca and Costa Brava. This is the one you should mostly be finding out about if you are looking to buy, sell and/or invest in a property here – and you will be happy to know that in prime locations such as Marbella, Mallorca and Ibiza the recovery began in 2013 and is now consolidating into real growth.

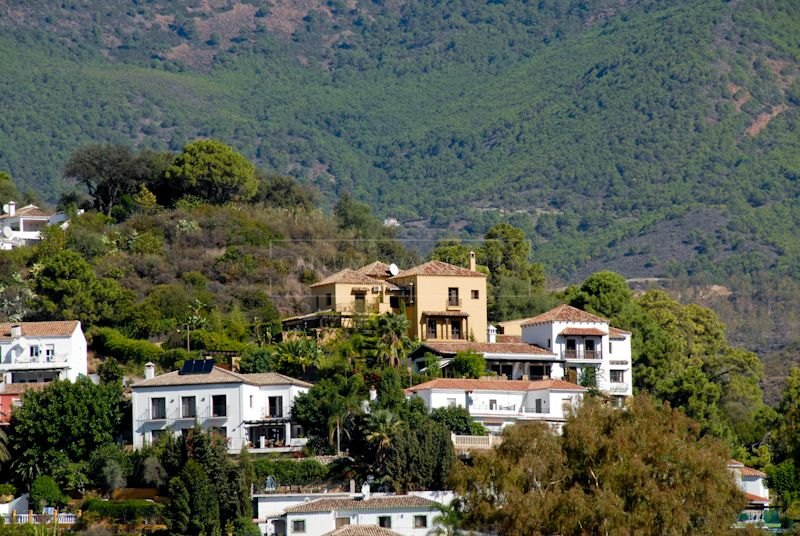

Indeed, in places such as Marbella we now talk not so much of recovery as of growth, and it is a far more buoyant and confident environment you will encounter than if you visited in, say 2010. At the time of writing, demand and property sales are growing gradually, bank repossessions have largely disappeared, distressed properties are pretty much a thing of the past, prices are beginning to edge upwards, home financing is becoming more readily available again, and the construction of small to medium-scale villa and apartment projects has begun again.

As a result land is in demand, investors from Europe, Asia and the USA are active, and the property and tourist sectors are once again the main drivers of economic growth in the region. What’s more, while it is essentially Marbella where this is taking place, the process is spreading out to surrounding areas such as Estepona and Mijas, and gradually also to Fuengirola, Benalmádena and Manilva.

Why buy a Marbella property now?

Because this is an ideal moment – at the beginning of an upward cycle in which demand is solid and growing, prices are slowly rising but still very attractive, and overall conditions are favourable, with low interest rates and economic growth consolidated within the Spanish national economy too.

Would you be right to totally ignore any information about the national market if you’re looking for a Marbella property?

No, by all means keep an eye on developments in the national primary housing market, but don’t think the findings necessarily apply to areas like Marbella too. In many cases they don’t, and while there are naturally linkages between the primary and secondary housing sectors, the Marbella real estate market in particular is one that is highly internationalised and more dependent upon the economies of Northern Europe than that of Spain itself. And with buyers coming from more different countries and regions than ever, it means its economic base is increasingly diversified, mature and stable too.